Payroll software is a computer program that automates the payment process for greater efficiency and reliability.

The software removes time-consuming work from HR personnel’s teeming to-do list, reduces error, and guarantees that people receive correct compensation on time.

Companies sell payroll software as a self-contained system or as an integrated component of a multipurpose HCM program.

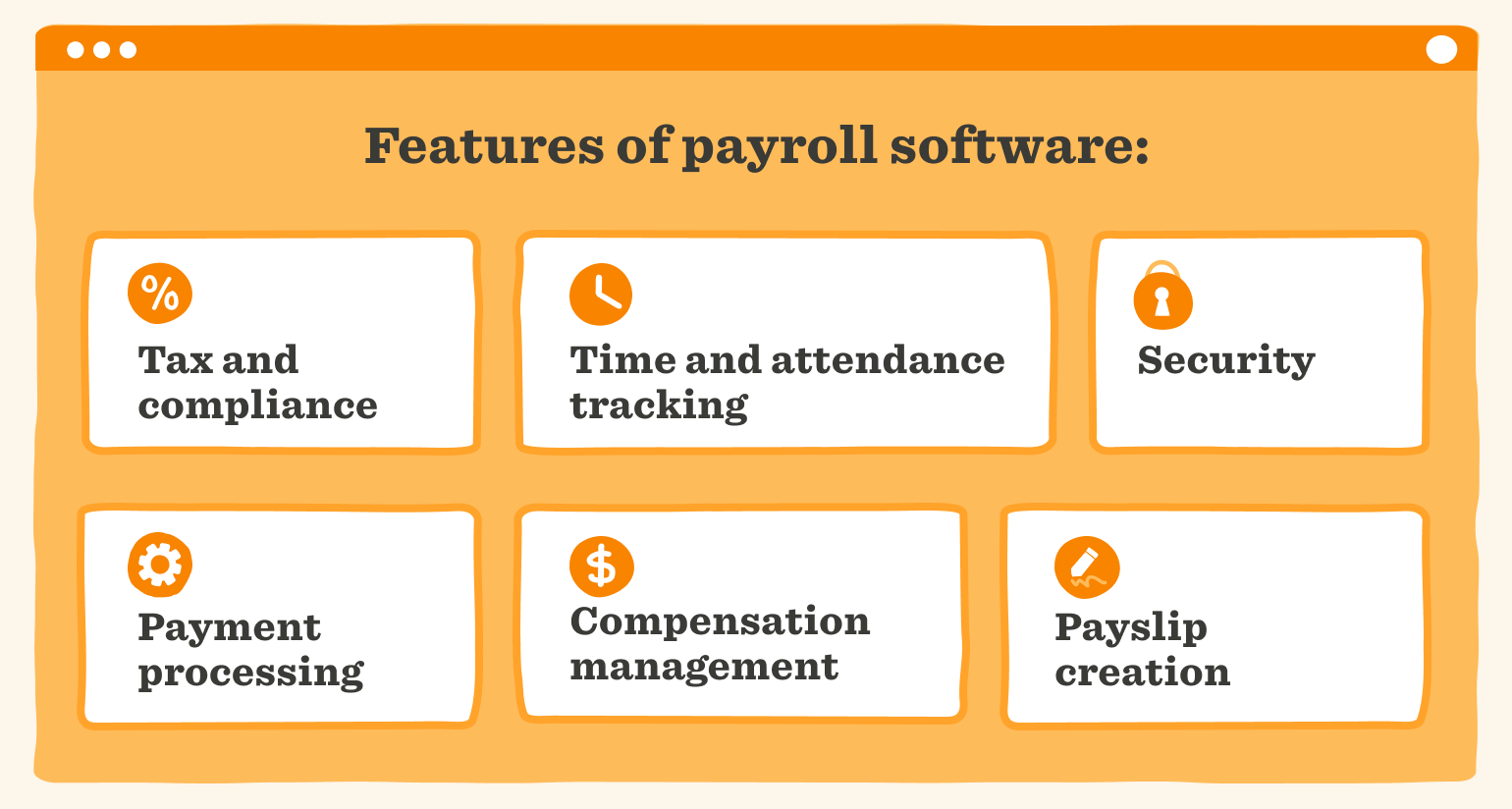

Key features of payroll software

Most payroll software offers features such as:

- Calculating tax withholdings and payment deductions

- Keeping track of working hours

- Printing paper checks

- Processing digital payments and deposits

- Providing employee self-service

- Safeguarding sensitive financial information

Payroll software enables businesses to comply with complicated government tax regulations, pay employees and independent contractors appropriately, provide efficient, customized payment methods, and offer a user-friendly user experience.

How payroll software works

Managing each payroll cycle, especially in larger organizations with hundreds of people, can get complicated.

Besides wages, it’s important to consider tax, compliance with local laws and regulations, time and attendance, as well as each person’s type of employment (whether they’re full-time, part-time, a contractor etc.).

HR payroll software makes this straightforward by automating the payment process, ensuring everyone receives compensation accurately and on time—while staying compliant.

So how does payroll software work exactly? It all starts with data:

Data input

Payroll software needs data to function. This includes information like time and attendance, salaries, bonuses, annual leave, sick leave, and any deductions. Payroll software is able to calculate each person’s pay based on those provided details.

Calculations

Payroll software considers all the different variables—like tax withholdings, retirement contributions, and health benefits—to calculate the net pay for each team member. It ensures the accuracy of every paycheck, minimizing human error.

Compliance

With ever-changing tax laws and regulations, it can be difficult to ensure compliance. Payroll software helps by automatically updating payment processes to match the latest regulations, ensuring your business is in line with local and national requirements.

Distribution

Once payroll software calculates everything, it takes care of distributing pay to the right people. Whether it’s direct deposit, checks, or even digital wallets, payroll software ensures your team members receive their pay promptly.

Reporting

Beyond just paying people, payroll software—especially when it integrates with other business systems—also offers reporting features that give you insights into your pay practices. This helps you see trends, ensure equity, and make data-driven decisions that benefit your entire organization.

Payroll software and compliance with tax laws

Tax laws are constantly evolving, and staying compliant means keeping up with every change. Payroll software can keep in step with the latest changes, automatically updating tax rates, adjusting to new regulations, or even updating a team member’s tax code when they move to a new location.

It means that HR, payroll, and finance teams don’t have to worry about missing a critical update. Payroll software ensures calculations are accurate and in line with the latest laws.

By ensuring organizations get tax and compensation right the first time, payroll software can minimize the risk of businesses receiving penalties for non-compliance.

What’s more, payroll software keeps a thorough record of all transactions, tax payments, and filings. This ensures you have everything you need to demonstrate compliance during an audit, or when taxes are due.

By using payroll software, your organization can navigate the complexities of tax laws with confidence, ensuring every paycheck is compliant and every tax filing is accurate—giving you greater peace of mind.

<<Are you missing a key step to compliance? Download our payroll compliance checklist.>>

The benefits of using payroll software

Payroll software comes with many benefits, including:

- Accuracy, every time. Automated calculations mean fewer errors and more confidence that your team members are receiving the right amount of compensation.

- Time-saving automation. Companies spend an average of five days on payroll (HiBob Pollfish 2024). Payroll software saves time by automating payroll tasks, freeing up your HR team to focus on strategic initiatives that support your people.

- Effortless compliance. Payroll software helps you stay up to date with changing regulations, laws, and tax rates, automatically keeping your payment processing and compensation management compliant.

- Simple reporting. Gain valuable insights into your pay practices with built-in reporting features, ensuring transparency and pay equity among your people.

- Enhanced security. Protect your organization’s and your people’s personal and financial data with tough security features that ensure privacy.

- Benefits management. Take care of perks such as pensions and health benefits, all in one place.

- Positive user experience. Payroll software simplifies the entire pay process, making it smoother, faster, and more reliable for everyone involved. Your people can access their payment information at any time and find the answers to their questions through employee self-service features. This creates a positive employee experience while easing the burden on HR and payroll teams at the same time.

Why should HR leaders care about payroll software?

Digital software systems help businesses of all sizes keep pace in the increasingly complex work landscape. HR and payroll software go hand in hand: Reducing paperwork and expenses, saving HR teams time, and promoting accurate and timely payments—a crucial component of your people’s satisfaction.

Moreover, while the finance department may manage payroll, it’s important that HR leaders still keep a finger on the payroll pulse—ensuring professionals receive accurate, timely payments, and optimal system functioning.

How to use payroll software

Getting started with payroll software is simpler than you might think. It’s designed to take the complexity out of payroll, so you can focus on what really matters—supporting your people.

Here’s how to make the most of it:

1. Set up your system

First, gather all the essential information—like your team members’ details, pay rates, tax information, and benefits. Input this data into the software so it can make the necessary calculations.

Most payroll software systems guide you through this step with easy-to-follow prompts, making setup simple.

2. Automate the process

Once your system is set up, the software can take over. It will automatically calculate salaries, taxes, and deductions during each pay cycle, ensuring everything is accurate and compliant. You can even set up direct deposits, so your team gets paid on time, every time, with minimal manual intervention.

3. Review and approve

Before each pay cycle, review the payroll summary to ensure everything looks right. The software will flag any discrepancies, but it’s always good to double-check. Once you’re satisfied, simply approve the payroll, and the software will handle the rest—distributing payments, updating records, and generating payslips.

4. Stay compliant

Payroll software keeps you on top of changing tax laws and regulations. It automatically updates with the latest rules, so you don’t have to worry about compliance.

And, it generates all the necessary tax documents and reports, making year-end filings straightforward.

5. Leverage reporting tools

Take advantage of the built-in reporting features to gain insights using payroll metrics. Whether you’re tracking overtime, monitoring benefits costs, or ensuring pay equity, you can create reports that give you the data you need to make informed decisions that benefit everyone.

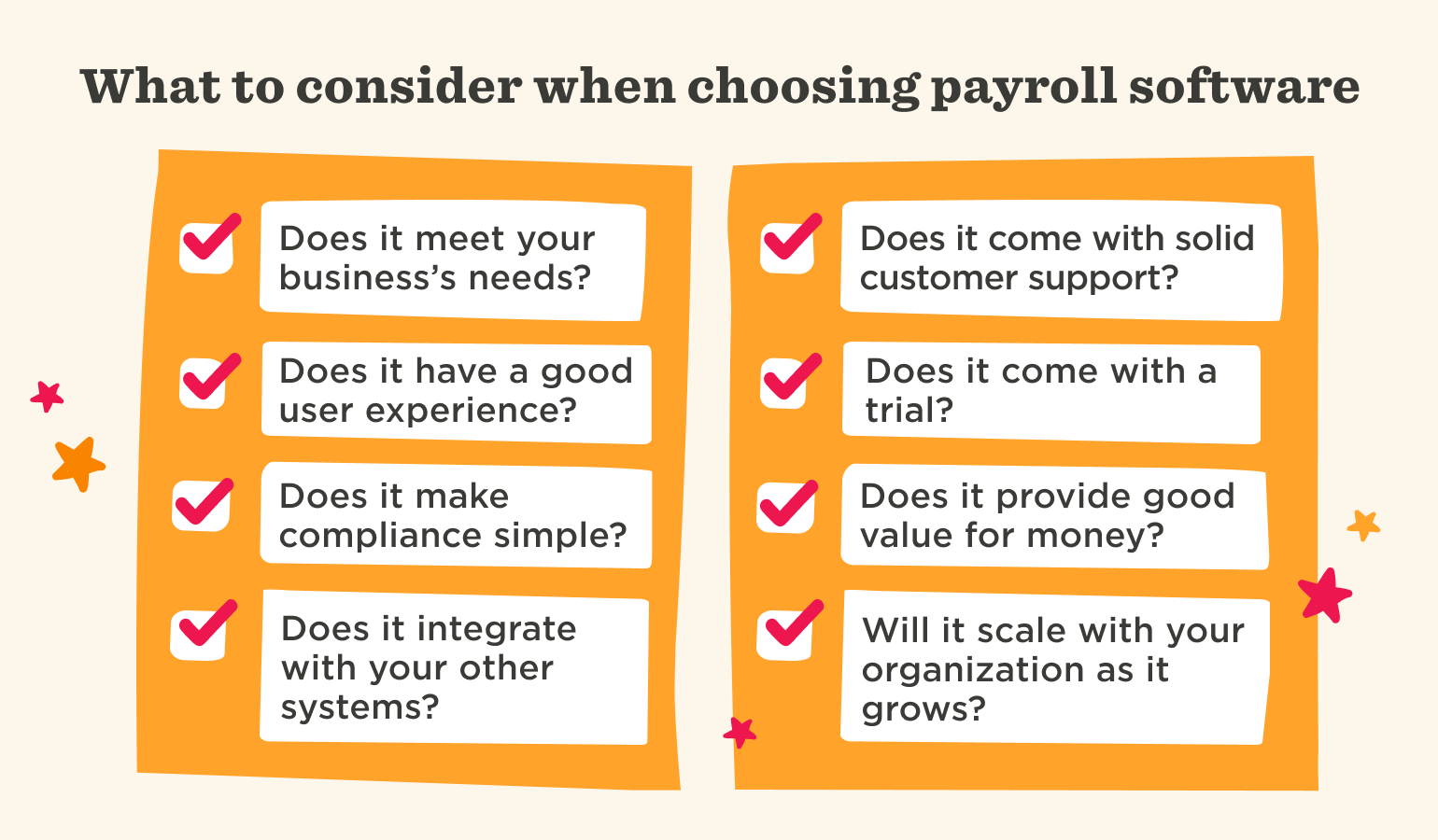

How to choose payroll software

Choosing payroll software is about finding a solution that aligns with your organization’s needs and makes payroll management as smooth as possible.

Here’s how to find the perfect fit:

1. Understand your needs

Start by considering what your organization really needs from payroll software. Are you looking for something that handles complex tax calculations? Or maybe you need a solution that integrates with your existing HR systems? Make a list of must-have features and nice-to-haves, so you know what to prioritize in your search.

2. Focus on user experience

Payroll software that’s intuitive and easy to use will create a positive experience for both your HR team and your people. Look for a platform with a clean, user-friendly interface that simplifies the payroll process.

Some platforms come with a Payroll Hub, a centralized dashboard where you can find all the payroll data you need in one place, for greater ease.

The less time you spend figuring out the software, the more time your team has to focus on the work they do best. An intuitive platform will lead to higher software adoption rates among your people and enhance the digital employee experience.

3. Check for compliance support

One of the key benefits of payroll software is staying compliant with tax laws and local regulations.

Make sure the software you choose automatically updates with the latest legal requirements and offers reliable compliance features. This will save you from potential headaches down the line.

4. Integration is key

Keep an eye out for payroll software that integrates with the other tools your organization uses, like your HRIS and accounting platforms. Look for solutions that offer easy integrations to simplify your processes and avoid duplication efforts that cost you time.

5. Consider scalability

As your organization grows, your payroll needs will evolve too. Choose software that can scale with you, that offers global payroll, and allows you to add more team members as needed.

Scalability ensures your payroll solution stays effective as your business changes, giving you the best value for money over time.

6. Prioritize customer support

Even the best software can run into issues from time to time.

That’s why it’s crucial to choose a provider with excellent customer support. Look for a company that offers responsive, knowledgeable assistance—whether through live chat, phone, or email—so you’re never left in the lurch when you need help.

7. Test the waters

Before making a final decision, take advantage of free trials or demos. This hands-on experience lets you see how the software fits with your day-to-day operations and whether it meets your expectations.

It’s the best way to ensure you’re making the right choice.

<<Need some help choosing the right payment solution? Download our comparison template.>>

What can HR leaders do to facilitate the successful implementation of payroll software?

HR leaders can incorporate these suggestions to prepare for implementing payroll software:

- Draft a comprehensive plan. It’s helpful if HR leaders include an implementation timeline to help the process meet goals and remain on track. HR can also examine and report upon the gap between the current payroll system and desired payroll objectives. Furthermore, including essential information such as employee classifications and pay frequencies can help HR seamlessly transfer over to a new system.

- Investigate. It’s important that HR leaders carry out research to find the software that addresses their needs. Does the payroll software offer services in the relevant countries? Does it include a robust security system? Can the software accommodate full-time employees as well as independent contractors? Does the software comply with the current taxation laws? Is it user-friendly?

- Collaborate. Cooperation between HR and IT ensures that the new payroll system fulfills the tech requirements and that the company tech infrastructure can accommodate the new payroll system. Perhaps the company wants to incorporate an HR IT interface to help HR and IT teams easily share information between different software programs.

- Enlist your people’s support. Team member and leadership backing of a new payroll system is fundamental to smooth system integration. ADP’s new blockbuster payroll program advises that HR leaders assemble teams to implement the new program while also preparing others to assume the regular workload. It helps if HR leaders also establish a training timeline, schedule, and clear expectations.

How does payroll software improve company culture?

A payroll software system that provides customized solutions to a company can drive greater efficiency, productivity, and greater satisfaction for your people. Guaranteeing that professionals receive the correct payment in a personalized and timely fashion promotes a positive work experience. Providing consistent, accurate compensation also strengthens the relationship between business leadership and their people, building integrity in the work community.

Payroll challenges solved

Payroll can be a challenging and complicated process. Businesses can be at risk of making mistakes that come with significant payroll costs—in the form of penalties, expensive changes, time, or the erosion of your people’s trust.

Payroll software can be the perfect solution for those challenges. Having a solid understanding of payroll software means you can find a solution that best addresses the needs and challenges of your business.

Payroll software frees up time for your HR team, reduces errors, and ensures everyone receives fair pay on time. It’s not just about making payments—it’s about supporting your people and maintaining a happy, productive workplace.

Key takeaways

- Payroll software automates the payment process, ensuring accurate and timely compensation for your team

- It reduces manual errors, saves time, and keeps businesses compliant with ever-changing tax laws and regulations

- Key features include tax calculation, payment processing, reporting, and team member self-service options

- Integrating payroll software with other HR systems enhances efficiency and streamlines operations

- Payroll software safeguards sensitive data with robust security measures, offering peace of mind for HR leaders

- By simplifying payroll management, the software supports a positive work culture and enhances team satisfaction.

Payroll software FAQs

How much is payroll software?

The cost of payroll software can vary depending on the features you need and the size of your business. Most pricing models use an annual or monthly subscription, with some offering per-person rates, so you only pay for what you use. When choosing a payroll solution, it’s important to consider not just the price, but the value it brings to your people—like pay accuracy and reduced admin time.

How to learn payroll software

Learning payroll software doesn’t have to be daunting. Most platforms offer user-friendly interfaces and extensive resources, including tutorials, webinars, courses, and support from real people to help you get started. Additionally, some systems offer hands-on training sessions to ensure you and your team feel confident using the software.

Is it difficult to switch to a new payroll software?

Switching to new payroll software is a big move, but it doesn’t have to be difficult. Payroll software providers design modern platforms with integration in mind, making data migration straightforward. Plus, with dedicated support teams, you’ll have guidance every step of the way to ensure a smooth transition for your business and your people.

Recommended For Further Reading

How secure is payroll software?

Payroll software tends to come with strong security features. It often includes encryption, regular security updates, and strict access controls to protect sensitive information. When choosing a payroll system, you can confirm with vendors that the platform in question safeguards your people’s data from potential threats.

Can HR and payroll software integrate with other systems?

Modern HR and payroll software can integrate with each other as well as other systems, such as time-tracking tools, accounting software, and performance management platforms. It pays to check whether certain systems are fully compatible with each other before you commit to a platform. To make it easier, some software combines HR modules and compensation management into one solution.