Today’s HR leaders have far more responsibilities than many people realize. They develop talent, drive engagement, and shape workplace morale. But as their responsibilities grow, so does the need for smarter, more efficient ways to manage them.

That’s where HR automation tools come in. With the right platform, HR leaders can upskill teams in analytics, build new tech skills to stay competitive, and streamline workflows. Automation not only speeds up admin tasks but also delivers data-driven workforce insights—freeing HR to focus on strategy instead of paperwork.

In this article, we’ll explore the best HR automation software and how it helps HR leaders get more done—faster.

Key insights

- HR automation tools streamline repetitive tasks, allowing HR leaders to focus on strategic initiatives and enhance workplace efficiency

- Automation improves accuracy by minimizing manual errors in processes like payroll, onboarding, and performance management

- Teams can build stronger company cultures and drive engagement without losing the human touch by adopting HR automation tools

What is an HR automation tool?

HR automation tools leverage artificial intelligence (AI) and other technologies to streamline and optimize HR processes. These tools take over repetitive, time-consuming tasks traditionally handled by HR professionals—such as data entry, payroll processing, and time-off management—freeing up teams to focus on strategic initiatives.

By incorporating technologies like machine learning (ML) and natural language processing (NLP), HR automation software can help reduce manual workloads, minimize errors, and improve efficiency. They also enhance decision-making by providing real-time insights, ensuring HR teams can work smarter and deliver a better experience for people across the organization.

Why is HR automation important?

HR teams manage everything from administrative tasks to big-picture strategy, all while supporting their people. But many of these tasks—like processing time-off requests, tracking applicants, and managing payroll—are repetitive and time-consuming.

By streamlining manual work, HR automation helps teams:

- Save time on routine tasks like adding up hours for payroll, tracking and approving paid time off requests, or generating reports for performance reviews

- Reduce human error by automatically checking for errors in salary calculations, benefits enrollments, or tax withholdings

- Generate intelligent workforce insights by collecting and analyzing HR data on hiring trends, employee engagement, or turnover risks

These benefits help HR teams automate time-consuming tasks, keep operations running smoothly as the company grows, and focus on the big-picture strategies that drive business growth.

Best HR automation tools

Let’s look at some of the best HR automation that can help you streamline HR processes and drive efficiency.

Recommended For Further Reading

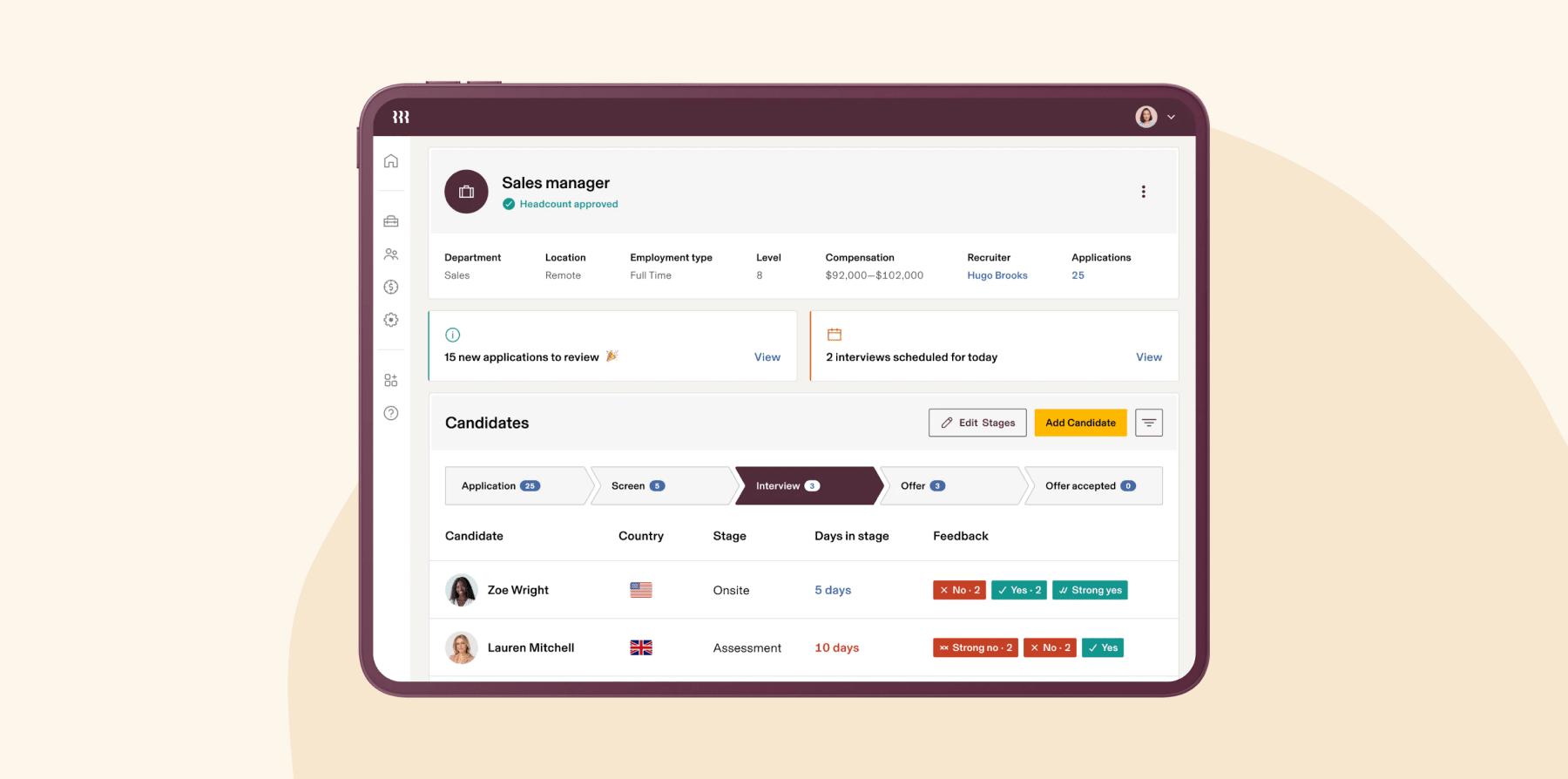

HiBob

HR leaders use HiBob’s automation tools to reduce manual work, speed up approvals, and simplify HR, payroll, and Finance workflows. Teams can automate onboarding processes, performance review cycles, payroll processing, and reporting to free up time for more strategic work.

They can also gain deeper insights with AskBob AI, which provides instant answers and actionable takeaways to optimize workflows. The HiBob AI Assistant helps HR teams auto-generate job descriptions, and candidate emails in seconds, while AI Insights uncovers workforce trends and analyzes survey sentiment to support smarter, data-driven decisions.

Beyond automation, HR teams rely on HiBob as a centralized hub for managing the entire employee lifecycle, connecting HR, payroll, and Finance with real-time, trusted data. They can integrate HiBob with communication tools, payroll systems, and other essential platforms to keep workflows connected and efficient. HiBob’s intuitive automation and hands-on implementation support means HR teams can quickly adopt and maximize AI-powered tools—even without prior experience with automation.

Features:

- AskBob AI: Access instant answers, automate actions, and deliver real-time insights to make the most of the platform

- Bob AI Assistant: Generate content for job descriptions and other common communications (shoutouts, polls, emails, etc.)

- AI Insights: Analyze workforce trends, survey sentiments, and HR reports to support data-driven decision-making

- Core HR: Automate essential HR tasks, create reports, and centralize team member data to streamline daily operations

- Hiring and Onboarding: Manage job postings, candidate pipelines, interview scheduling, and onboarding workflows to streamline the recruitment journey

- Payroll Hub: Centralize payroll data and integrate with external systems to reduce preparation time

Pros:

- Delivers AI-powered insights to help HR teams proactively address workplace challenges

- Eliminates manual work by generating original writing for emails, job descriptions, and company announcements

- Provides real-time people data and customizable reports to track trends, measure engagement, and support data-driven decisions

- Supports workforce-wide learning programs to help people develop skills and advance their careers

- Offers an intuitive, easy-to-adopt platform that minimizes onboarding time for HR teams and team members

- Combines payroll, performance management, engagement, and compliance in one system

- Reduces the need for multiple tools in a tech stack by integrating seamlessly with existing HR software

Cons:

- “We miss the yellow faces in the reviews—it made them so much more engaging. Please bring them back!.” – verified review

- “I’d love it if HiBob had an escalation system for tasks!” – verified review

Pricing: Contact the HiBob team for a custom pricing plan.

Rippling

Rippling is a workforce management platform that unites HR, IT, and finance operations. Rippling’s Workflow Studio allows users to create custom automated workflows for tasks like onboarding, offboarding, and policy enforcement. It also uses the AI-powered tool Talent Signal to assess new joiners’ initial work output.

Features:

- Talent Signal: Evaluate the first 90 days of a new joiner’s work with performance insights

- Workflow Studio: Create custom automated workflows to manage HR, IT, and finance tasks

- Candidate feedback summaries: Use AI to generate concise evaluations of potential candidates

- Onboarding automation: Trigger onboarding actions based on new joiner attributes

Pros:

- “I have no trouble integrating with the current HR operations and systems.” – verified user

- “The icons on the left hand side make it easy to find what I need.” – verified user

Cons:

- “There are a lot of (basic) missing features that our other software had.” – verified user

- “I don’t like the org chart. I find it difficult to navigate.” – verified user

Pricing: Pricing is not publicly available.

<<Compare HiBob vs. Rippling – See which fits your business best>>

UKG Pro

UKG Pro is an AI-powered HR solution. The platform’s UKG Bryte AI Agents leverage large action models to give personalized recommendations to improve decision-making. UKG Pro also offers AI-powered analytics to audit large datasets for payroll accuracy.

Features:

- UKG Bryte AI Agents: Automate HR tasks like job descriptions and report generation

- Payroll auditing: Analyze payroll for accuracy and compliance

- Scheduling: Create work schedules that align labor resources with demand

- Sentiment analysis: Receive AI guidance on how to improve the workplace culture

Pros:

- “I really like how I can view all of my payment details.” – verified user

- “It makes requesting time off extremely fast and convenient.” – verified user

Cons:

- “Reporting is its own monster that can be hard to learn, and even harder to teach new people about.” – verified user

- “I don’t like the user interface; it’s not user friendly.” – verified user

Pricing: Pricing is not publicly available.

<<Compare HiBob vs. UKG – See which fits your business best>>

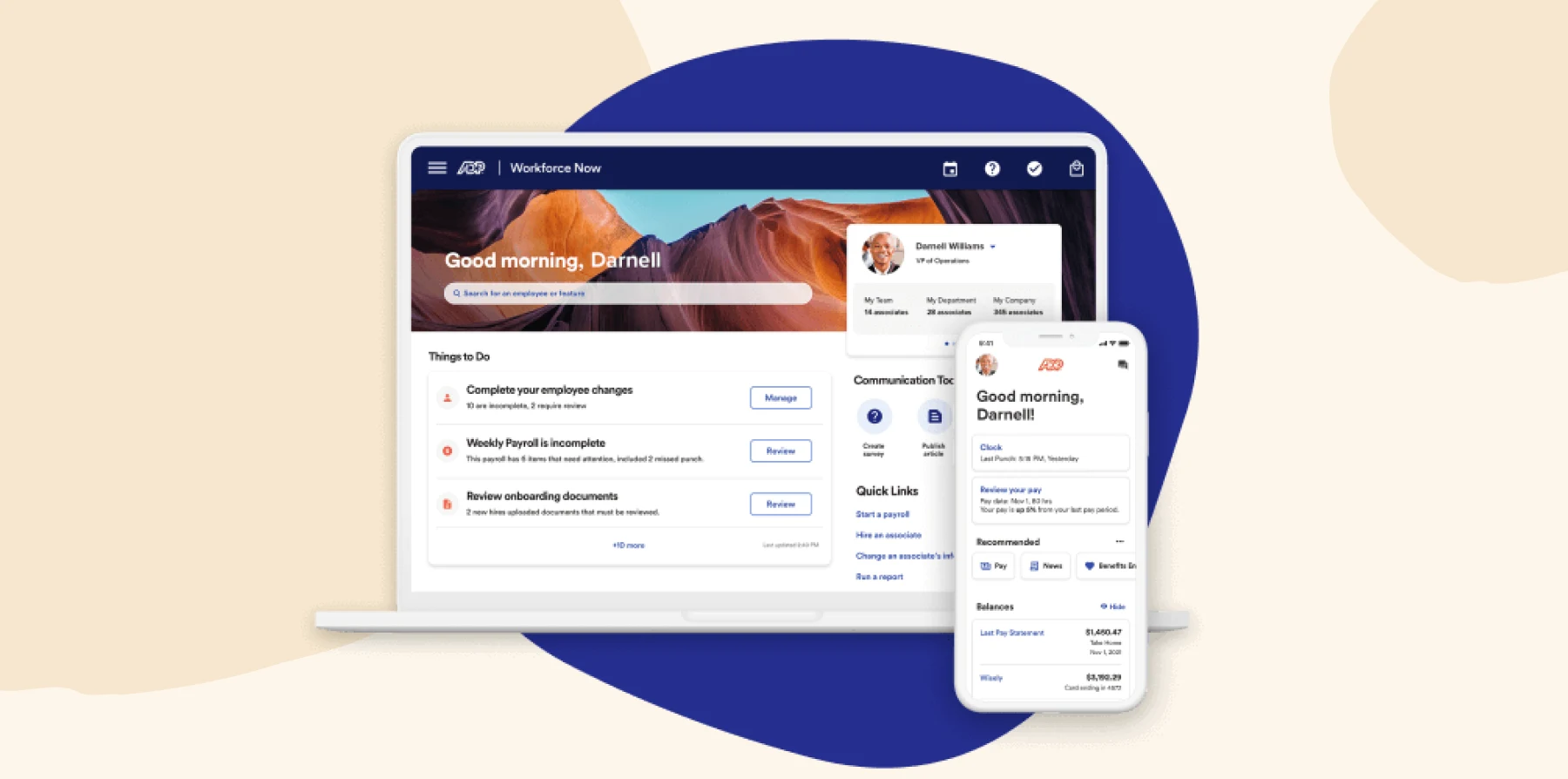

ADP Workforce Now

ADP Workforce Now is a human capital management (HCM) software that helps businesses automate payroll and HR report generation. The platform uses ADP Assist to automatically generate workforce analytics and predictive insights. It also includes tools for payroll automation, compliance tracking, and talent management.

Features:

- ADP Assist: Generate workforce insights and automate HR reporting

- Payroll automation: Create pay information from your HCM or ERP system and send it directly into ADP as a paydata batch

- Time and attendance: Track work hours, breaks, and overtime automatically

- Onboarding: Automatically provide the information and support new joiners need before their first day

Pros:

- “l love the system, it’s user friendly.” – verified user

- “The mobile app works, it is so easy to clock in and out.” – verified user

Cons:

- “The Onboarding portion is a bit lacking.” – verified user

- “The training required for implementation could be overwhelming.” – verified user

Pricing: Pricing is not publicly available.

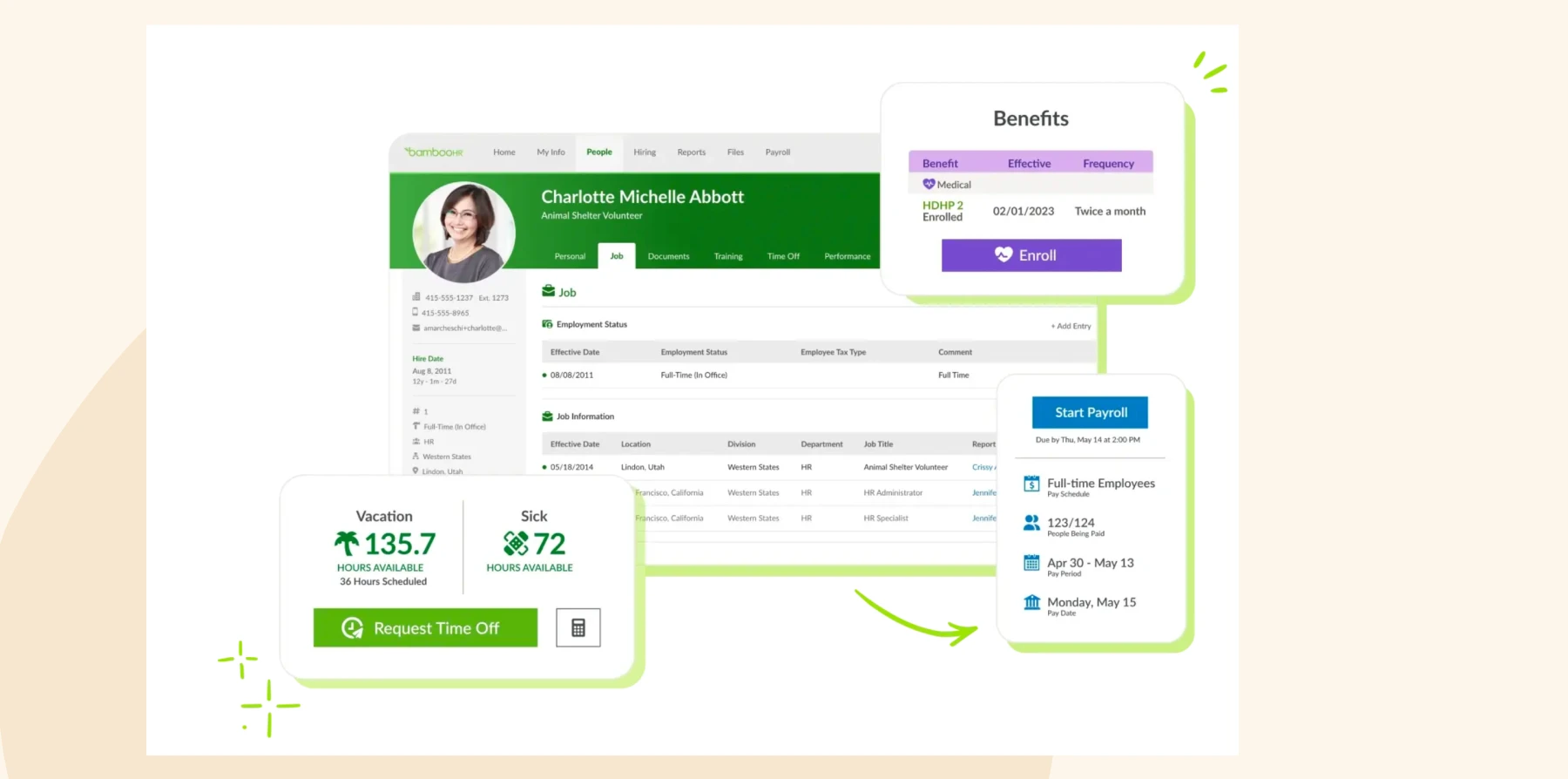

Bamboo HR

BambooHR is an HR software with AI and automation tools. It offers automated workflows for tasks like onboarding, time-off management, and performance tracking and has AI Topic Summaries for Employee Satisfaction surveys, which automatically analyze team member feedback to identify key themes and trends.

Features:

- Automated onboarding: Streamline document collection and task assignments for new joiners

- Time tracking: Calculate total hours, overtime, PTO, and holiday pay.

- Applicant tracking: Auto-populate candidate info and customizable offer letter templates for qualified prospects

- Sentiment analysis: Automatically summarize feedback to highlight key themes and trends

Pros:

- “I can pull so much helpful data very easily.” – verified user

- “Payroll is straightforward and convenient.” – verified user

Cons:

- “The hiring portal is very weak.” – verified user

- “My one wish would be for Bamboo to automate more processes.” – verified user

Pricing: Pricing is not publicly available.

<<Compare HiBob vs. BambooHR – See which fits your business best>>

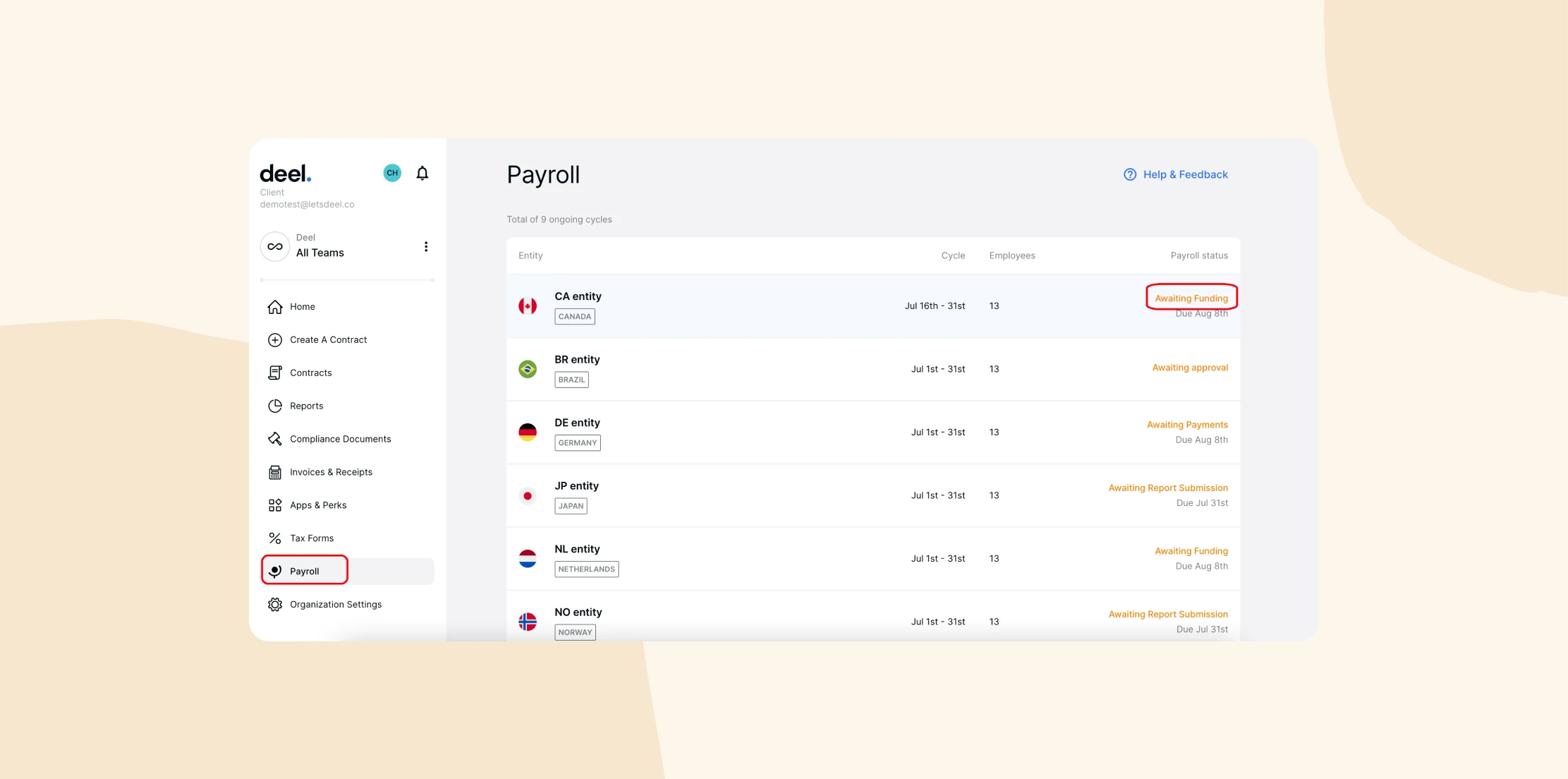

Deel

Deel is a global HR and payroll platform that can streamline workforce management. The platform uses AI and automation for features like automated payroll calculations, compliance monitoring, and analytics. Deel also provides tools for onboarding, time-off management, and performance tracking.

Features:

- Automated payroll processing: Calculate salaries, taxes, and deductions

- Compliance monitoring: Continuously track changes in labor laws and tax regulations across regions

- Onboarding: Automate paperwork collection online

- Invoice management for contractors: Automate payments, invoice generation, payslips, and taxes for contractors.

Pros:

- “I love how it handles different currencies.” – verified user

- “Deel was a very clear and easy way to sign my international contract.” – verified user

Cons:

- “I do dislike how oddly glitchy the mobile app can get.” – verified user

- “Onboarding was dreadful.” – verified user

Pricing: Deel offers a variety of plans covering HR operations, global payroll, hiring, IT management, and immigration support.

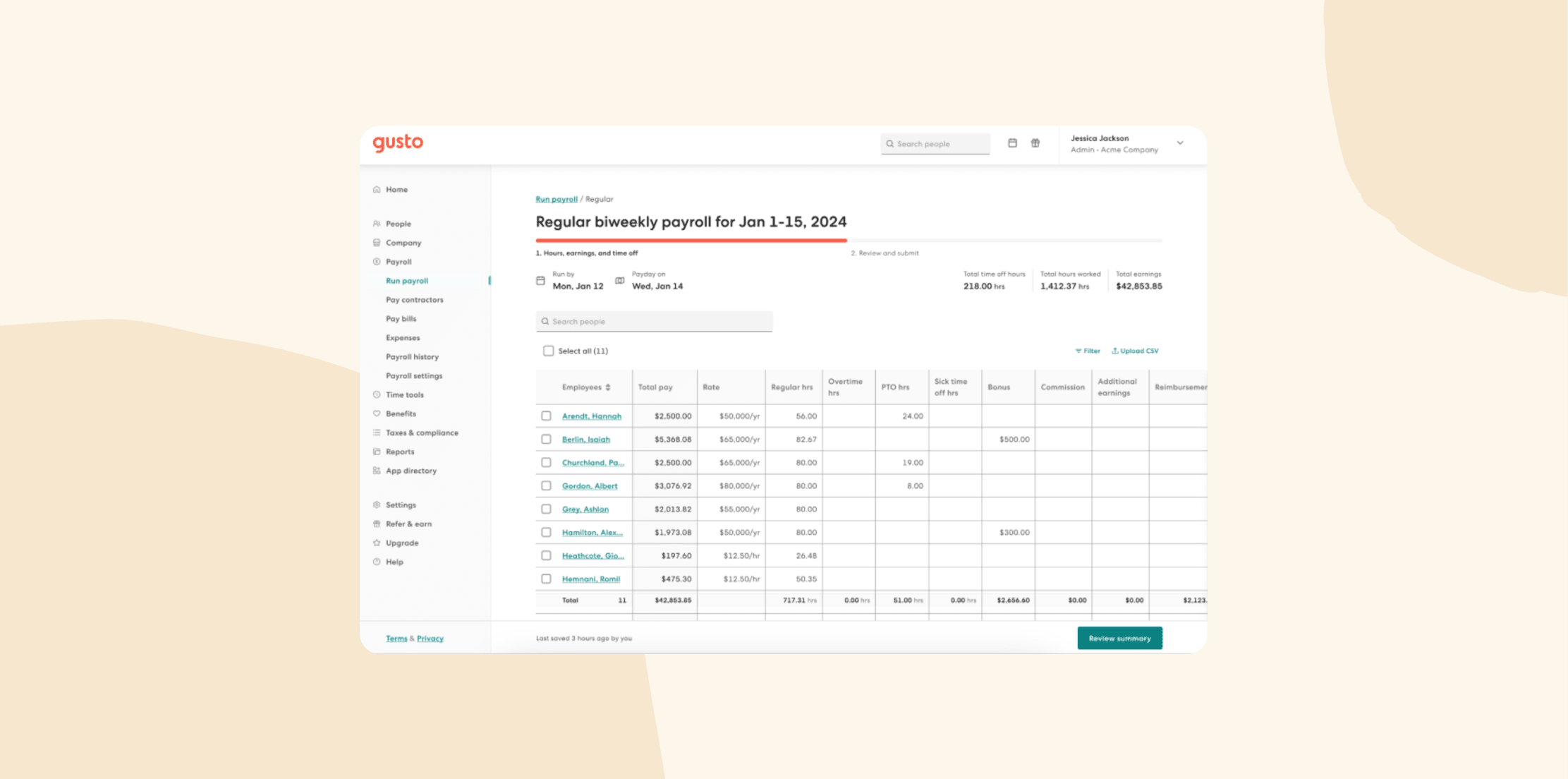

Gusto

Gusto is an HR and payroll platform that uses AI and automation to enhance HR processes. It automates payroll tax calculations, benefits administration, and compliance tracking. Gusto also includes AI-powered hiring tools, like job deposit generators and candidate sourcing recommendations.

Features:

- Automated payroll: Continually process pay, taxes, and deductions for paychecks

- Gus: Access an AI assistant that can answer frequently asked questions and generate workforce insights

- Applicant tracking system (ATS): Screen and sort job applications

- Job post generator: Generate job postings based on the role information you input

Pros:

- “Easy to swap between employee and admin profiles.” – verified user

- “Created a better experience for our employees.” – verified user

Cons:

- “I do wish we could automate our payroll.” – verified user

- “You can not automate contractor invoice payments or approvals.” – verified user

Pricing:

- Simple: $40/mo

- Plus: $80/mo

- Premium: $180/mo

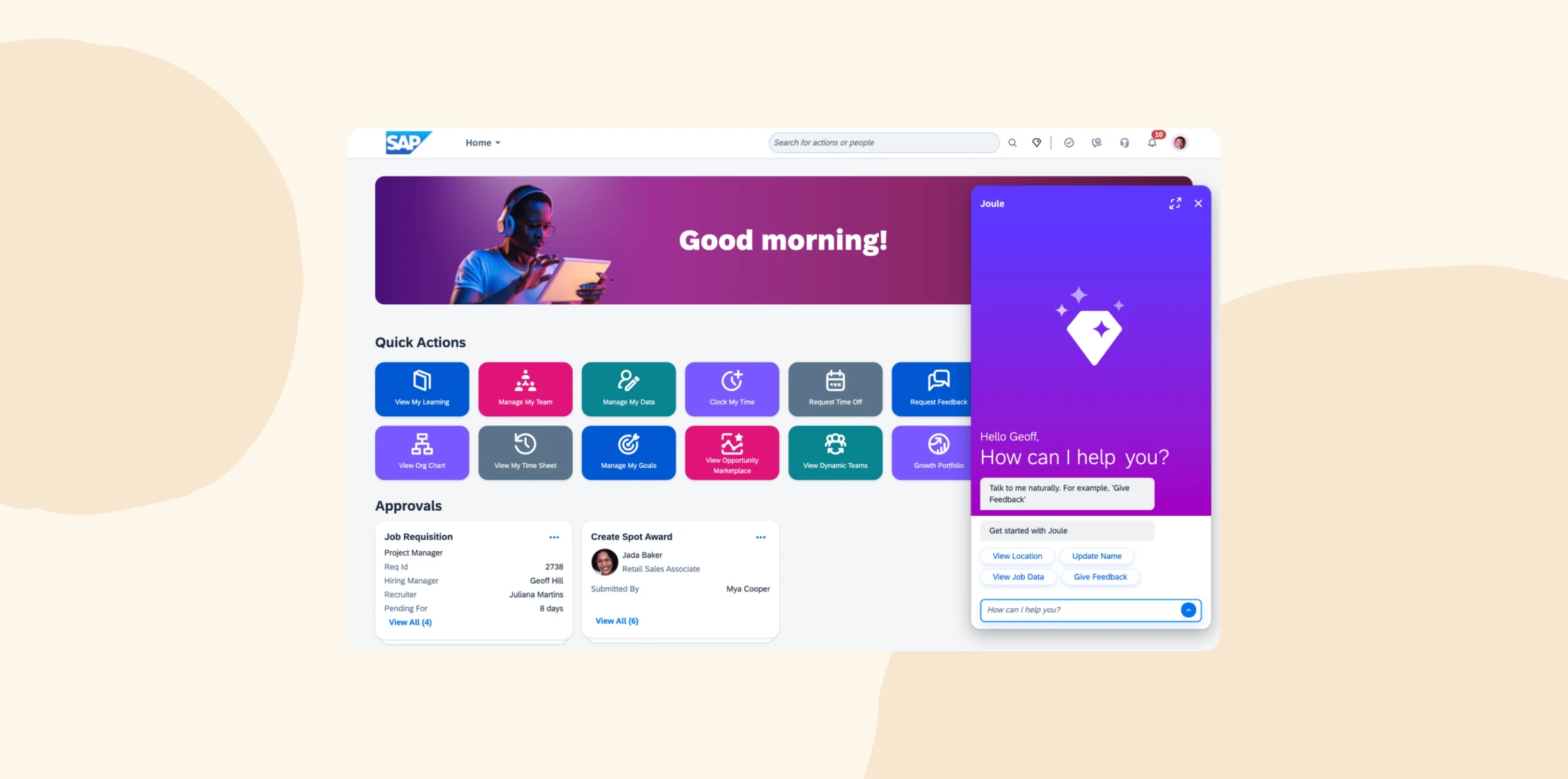

SAP Success Factor

SAP SuccessFactors is an HCM suite that can optimize HR processes and enhance team member experiences. It can automate document collection from new joiners, time and attendance tracking for payroll, and recommendations for growth opportunities specific to every team member. Users can also customize reports to automatically generate any workforce insights they need for stakeholders.

Features:

- Payroll: Automate payroll calculations for hours worked

- Recruiting: Automate job postings and workflows for contacting potential candidates

- Learning management system (LMS): Access personalized learning suggestions based on individual skills and career aspirations

- Candidate skill matching: Align candidate skills with job requirements

Pros:

- “Brings all HR tasks together in one easy-to-use system.” – verified user

- “Works well across different countries and languages.” – verified user

Cons:

- “The software can be quite complex.” – verified user

- “Costly—implementing small updates needs a costly vendor for implementation.” – verified user

Pricing: Pricing is not publicly available.

<<Compare HiBob vs. SAP SuccessFactors – See which fits your business best>>

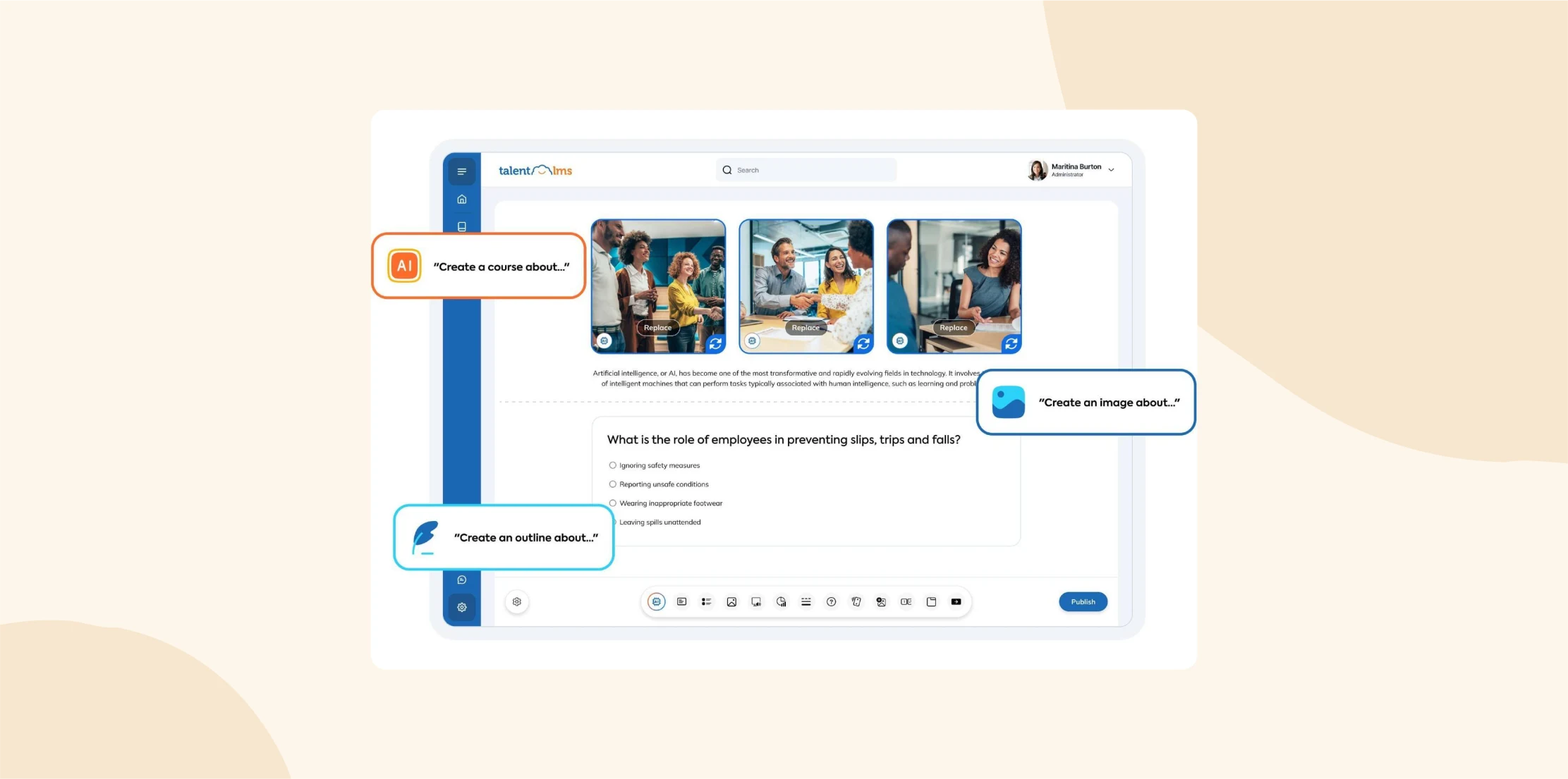

Talent LMS

TalentLMS is a learning management system (LMS) that offers training programs for learning and development. It features TalentCraft, an AI-powered content creation tool that assists in developing course materials. TalentLMS also offers automated workflows for course enrollment, progress tracking, and reporting.

Features:

- TalentCraftr: Develop course content like text, images, and quizzes

- Automated enrollment and tracking: Manage learner registrations and monitor progress through predefined workflows

- Adaptive learning paths: Personalize training experiences by adjusting content delivery based on individual learner performance

- Reporting: Generate analytics on learner engagement and course effectiveness

Pros:

- “Training others to use the product takes a little time.” – verified user

- “It really allows us to put out modern-looking training.” – verified user

Cons:

- “Limited options when it comes to reporting on certain metrics for users.” – verified user

- “It is too expensive.” – verified user

Pricing:

- Core: Starts at $119/mo

- Grow: Starts at $299/mo

- Pro: Starts at $399/mo

- Enterprise: Custom pricing

Workday

Workday is an enterprise cloud application suite with tools to optimize HR and financial management processes. Workday’s Recruiter Agent can automate recruiting tasks for candidates. It also integrates AI capabilities through Workday Illuminate to help with content creation.

Features:

- Recruiter Agent: Automate candidate sourcing and interview scheduling

- Contract Analysis: Compare signed contracts against existing data to identify discrepancies

- Growth plans: Automate the creation of growth plans and suggest relevant projects and development opportunities

- Workday Illuminate: Streamline writing and summarizing job descriptions, talent highlights, and knowledge articles

Pros:

- “You don’t need any experience in coding language.” – verified user

- “The dashboard clearly shows tasks, candidate reviews, and scheduling information.” – verified user

Cons:

- “Workday is a complex tool, and I went through a steep learning curve to navigate the platform.” – verified user

- “The cost is high for a small organization.” – verified user

Pricing: Pricing is not publicly available.

<<Compare HiBob vs. Workday – See which fits your business best>>

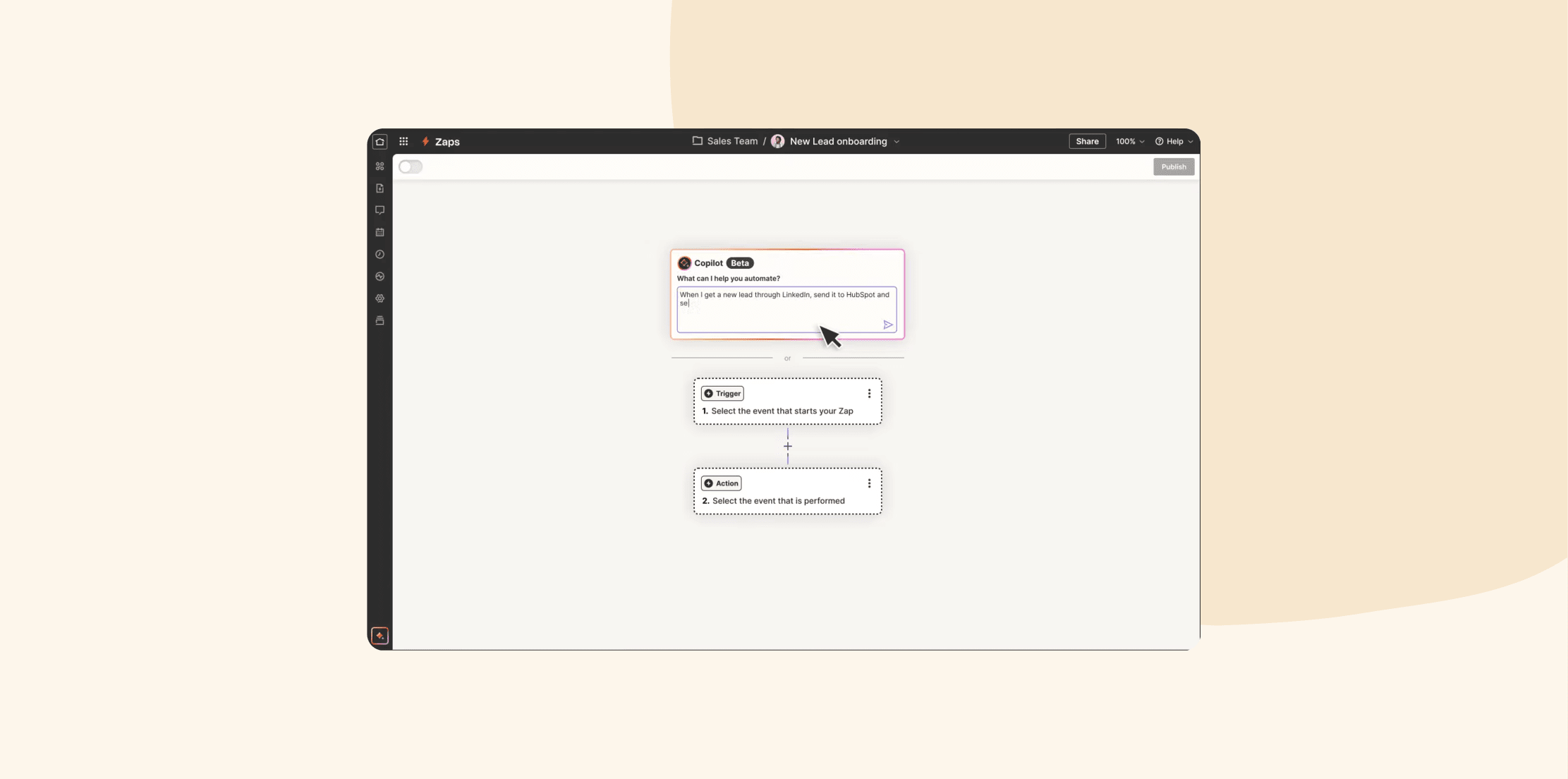

Zapier

Zapier is an automation platform that works with over 7,000 apps. It enables HR leaders to create workflows without coding or manual intervention. Users can set flows for tasks like sharing job openings across different platforms, getting notified of new applications, and moving email attachments, like resumes, to an organized folder in your cloud storage.

Features:

- Onboarding and offboarding: Automatically assign tasks, send welcome emails, and update HR systems when people join or leave the organization

- Resume parsing and candidate management: Parse resumes from emails and add candidate information directly into applicant tracking systems or databases

- Data synchronization: Keep team information consistent across platforms by syncing data between HR systems, payroll, and communication tools

- Training and development: Automate the assignment and tracking of training sessions

Pros:

- “Allowed us to automate workflows in new ways.” – verified user

- “Easy user interface with proper support and documentation.” – verified user

Cons:

- “I don’t like how often it needs manual fixing and editing.” – verified user

- “Zapier and the integrations we were using needed more monitoring than I would have anticipated.” – verified user

Pricing: Pricing is not publicly available

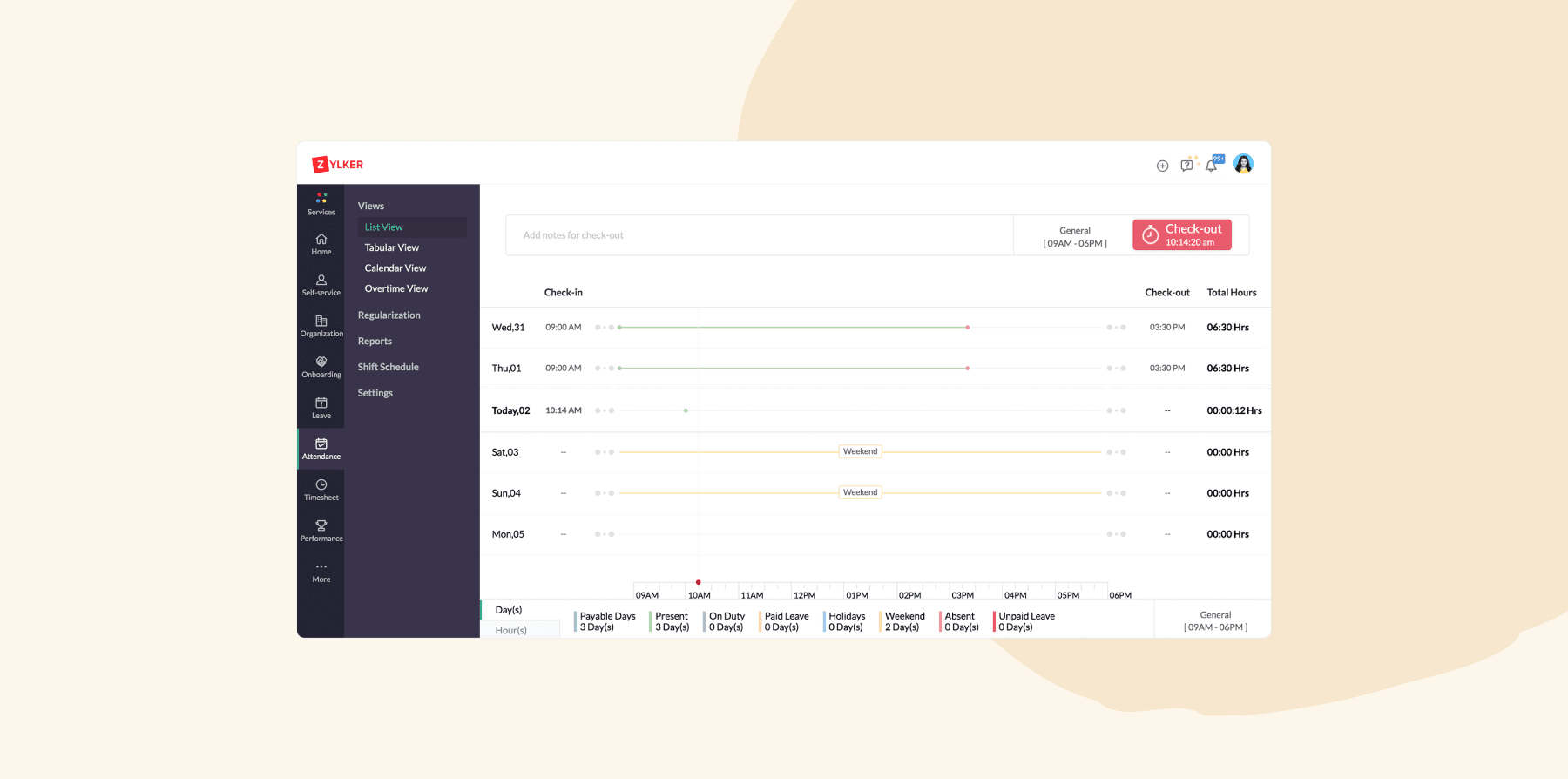

Zoho People

Zoho People is an online HR solution that features workflow automation, custom functions, and AI-powered scheduling. Zia, Zoho’s AI assistant, can collect customer data for analysis and reporting. It can also help with creative efforts like writing a document.

Features:

- Workflow automation: Automate manual administrative work

- Custom functions: Write code to perform automated actions for specialized requirements of your organization

- Scheduler: Automate routine tasks by scheduling them at predefined intervals

- Time and attendance tracking: Track attendance for payroll processing

Pros:

- “It helps to recognize the performance of the well deserved employees.” – verified user

- “Requesting a leave is straightforward.” – verified user

Cons:

- “It takes a considerable amount of time to understand and set up the product (roles and permissions).” – verified user

- “Impossible to edit old entries (if you forgot to add something). Impossible to fix errors (like missing dates). Cannot remove old tasks.” – verified user

Pricing:

- Essential HR: $1.50/mo per user

- Professional: $2.50/mo per user

- Premium: $3.50/mo per user

- Enterprise: $5.00/mo per user

- People Plus: $10.00/mo per user

Choose the best HR automation tool for your team

The right automation tool eliminates repetitive HR tasks, allowing leaders to process approvals faster, generate reports instantly, and track workforce trends in real time. This not only boosts efficiency but also empowers HR teams to focus on what matters most—building a strong company culture, building engagement, and supporting their people.

For those looking for an all-in-one HR automation platform, consider HiBob. HR leaders can use HiBob to automate onboarding, time tracking, performance reviews, and reporting. For teams that want to go further, HiBob’s AI-powered tools provide instant answers, generate HR content, and analyze workforce trends, helping leaders make smarter decisions with less effort.

HR automation FAQS

Is HR going to be replaced by automation?

HR tools for automation can handle repetitive tasks, but they cannot replace the human side of human resources. Building relationships, resolving conflicts, and fostering a strong workplace culture all require real human interaction. Instead of replacing leaders, HR tech enhances workplace experiences by freeing up time for important face-to-face work like coaching team members and driving engagement.

Are there disadvantages of HR automation?

Learning a new tool and setting up HR automations correctly takes time. Without proper configuration, workflows might not deliver the expected results. However, you can gain many advantages by choosing a platform with strong implementation support like HiBob. HiBob’s implementation team helps users understand the technology with hands-on guidance.

What is an HR automation system?

An HR automation system uses technology to handle repetitive HR tasks like processing payroll, managing team records, or tracking time-off requests. Instead of manually entering data or approving requests one by one, HR teams can set up workflows that run automatically. Teams use automated workflows to free up their time so they can focus on face-to-face interactions with the people who make their company stand out.

Which is the best HR software for automation?

The best HR automation software depends on your team’s needs. Some companies need recruiting automation, while others prioritize workflow approvals and HR analytics. For those looking to streamline every HR process without losing the human touch, HiBob offers intuitive automation for onboarding, time-off approvals, performance management, and more.

Disclaimer:

This content reflects HiBob’s perspective, informed by our experience supporting HR teams as they evaluate and implement HR software. It is provided for informational purposes only and is not intended as independent research or professional advice. Prospective users should conduct their own evaluation before making a decision.

Feature descriptions, pricing references, and availability for third-party platforms are based on publicly available information at the time of publication and may change. HiBob does not guarantee the accuracy or completeness of information related to third-party products. Prospective users should verify details directly with each provider.

![12+ Best HR Automation Tools For Your Team [2025]](https://res.cloudinary.com/www-hibob-com/w_550,h_234,c_fit/fl_lossy,f_webp,q_auto/wp-website/uploads/Blog_Best-HR-automation-tools_Featured-image.png)